Laskentatoimen ja rahoituksen yksikön tutkimus

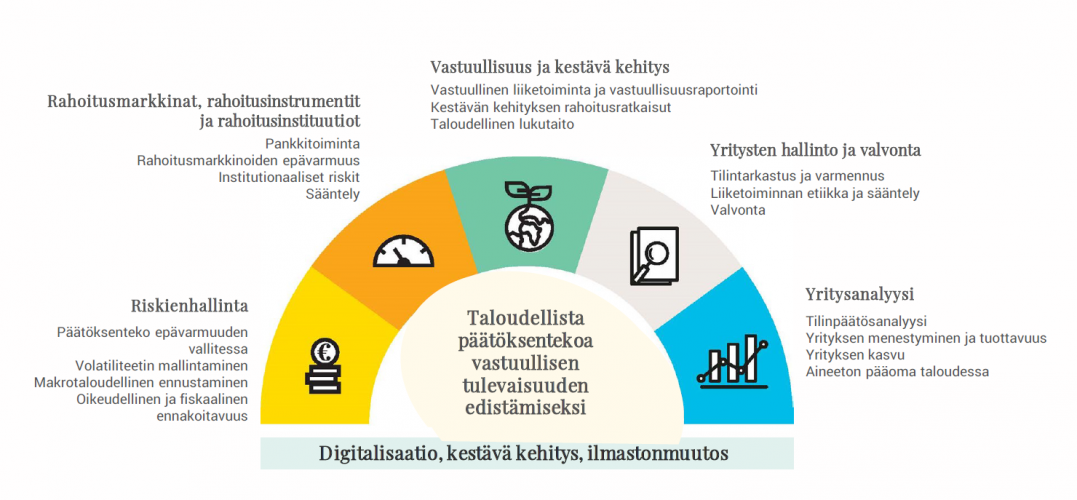

Tutkimuksemme fokus: Taloudellista päätöksentekoa vastuullisen tulevaisuuden edistämiseksi

Julkaisut

Tutustu kaikkiin julkaisuihimme SoleCRIS-tutkimustietokannassa tai valikoituihin julkaisuihin tutkimuksemme fokusalueilla:

- Yritysanalyysi

-

- Andreeva, T., & Garanina, T. (2016). Do all elements of intellectual capital matter for organizational performance? evidence from Russian context. Journal of Intellectual Capital, 17(2), 397-412.

- Davydov, D. (2016). Debt structure and corporate performance in emerging markets. Research in International Business and Finance, 38, 299-311.

- Jones, D. C., Kalmi, P., Kato, T., & Mäkinen, M. (2020). The differing effects of individual and group incentive pay on worker separation: Evidence using Finnish panel data. International Journal of Human Resource Management, forthcoming.

- Mättö, T., Anttonen, J., Järvenpää, M., & Rautiainen, A. (2019). Legitimacy and relevance of a performance measurement system in a Finnish public-sector case. Qualitative Research in Accounting and Management, 17(2), 177-199.

- Piekkola, H. (2020). Intangibles and innovation-labor-biased technical change. Journal of Intellectual Capital, 21(5), 649-669.

- Rahko, J. (2016). Internationalization of corporate R & D activities and innovation performance. Industrial and Corporate Change, 25(6), 1019-1038.

- Rahoitusmarkkinat, rahoitusinstrumentit ja rahoitusinstituutiot

-

- Boubaker, S., Nguyen, D. K., Piljak, V., & Savvides, A. (2019). Financial development, government bond returns, and stability: International evidence. Journal of International Financial Markets, Institutions and Money, 61, 81-96.

- Davydov, D., Fungácová, Z., & Weill, L. (2018). Cyclicality of bank liquidity creation. Journal of International Financial Markets, Institutions and Money, 55, 81-93.

- Davydov, D., Vähämaa, S., & Yasar, S. (2021). Bank liquidity creation and systemic risk. Journal of Banking and Finance, forthcoming.

- Ferri, G., Kalmi, P., & Kerola, E. (2014). Does bank ownership affect lending behavior? evidence from the euro area. Journal of Banking and Finance, 48, 194-209.

- Grobys, K., & Kolari, J. (2020). On industry momentum strategies. Journal of Financial Research, 43(1), 95-119.

- Grobys, K., Ruotsalainen, J., & Äijö, J. (2018). Risk-managed industry momentum and momentum crashes. Quantitative Finance, 18(10), 1715-1733.

- Orlov, V. (2016). Currency momentum, carry trade, and market illiquidity. Journal of Banking and Finance, 67, 1-11.

- Yritysten hallinto ja valvonta

-

- Garanina, T. & Muravyev, A. (2021). The gender composition of corporate boards and firm performance: Evidence from Russia. Emerging Markets Review, forthcoming.

- Haapamäki, E., & Sihvonen, J. (2019). Research on international standards on auditing: Literature synthesis and opportunities for future research. Journal of International Accounting, Auditing and Taxation, 35, 37-56.

- Jokipii, A., & Di Meo, F. (2019). Internal audit function characteristics and external auditors' co-sourcing in different institutional contexts. International Journal of Auditing, 23(2), 292-307.

- Järvinen, T., & Myllymäki, E. (2016). Real earnings management before and after reporting SOX 404 material weaknesses. Accounting Horizons, 30(1), 93-118.

- Laitinen, E. K., & Laitinen, T. (2015). A probability tree model of audit quality. European Journal of Operational Research, 243(2), 665-677.

- Palvia, A., Vähämaa, E., & Vähämaa, S. (2020). Female leadership and bank risk-taking: Evidence from the effects of real estate shocks on bank lending performance and default risk. Journal of Business Research, 117, 897-909.

- Vastuullisuus ja kestävä kehitys

-

- Baselga-Pascual, L., Trujillo-Ponce, A., Vähämaa, E., & Vähämaa, S. (2018). Ethical reputation of financial institutions: Do board characteristics matter? Journal of Business Ethics, 148(3), 489-510.

- Dutta, A., Bouri, E., Saeed, T., & Vo, X.V. (2020). Impact of energy sector volatility on clean energy assets. Energy, forthcoming.

- Dutta, A., Bouri, E., & Noor, M.H. (2018). Return and volatility linkages between CO2 emission and clean energy stock prices. Energy, 164, 803-810.

- Dutta, P., & Dutta, A. (2021). Impact of external assurance on corporate climate change disclosures: New evidence from Finland. Journal of Applied Accounting Research, forthcoming.

- Garanina, T. & Aray, Y. (2021) Enhancing CSR disclosure through foreign ownership, foreign board members, and cross-listing: Does it work in Russian context? Emerging Markets Review, forthcoming.

- Onkila, T., Mäkelä, M., & Järvenpää, M. (2018). Employee sensemaking on the importance of sustainability reporting in sustainability identity change. Sustainable Development, 26(3), 217-228.

- Riskienhallinta

-

- Addo, K. A., Hussain, N., & Iqbal, J. (2021). Corporate governance and the systemic risk: A test of bundling hypothesis. Journal of International Money and Finance, forthcoming.

- Dimic, N., Kiviaho, J., Piljak, V., & Äijö, J. (2016). Impact of financial market uncertainty and macroeconomic factors on stock-bond correlation in emerging markets. Research in International Business and Finance, 36, 41-51.

- Dutta, A., Nikkinen, J., & Rothovius, T. (2017). Impact of oil price uncertainty on Middle East and African stock markets. Energy, 123, 189-197.

- Grobys, K. (2018). Risk-managed 52-week high industry momentum, momentum crashes and hedging macroeconomic risk. Quantitative Finance, 18(7), 1233-1247.

- Nikkinen, J., & Rothovius, T. (2019). Energy sector uncertainty decomposition: New approach based on implied volatilities. Applied Energy, 248, 141-148.

- Palvia, A., Vähämaa, E., & Vähämaa, S. (2015). Are female CEOs and chairwomen more conservative and risk averse? Evidence from the banking industry during the financial crisis. Journal of Business Ethics, 131(3), 577-594.

Tutkimusryhmät

Teemme tutkimusta neljässä tutkimusryhmässä: Auditing and Control in Accounting, Finance and Financial Accounting, Talousoikeudellisen informaation tutkimusryhmä ja Taloustieteen tutkimusryhmä.

Vaikuttavaa tutkimusta Tutkimushankkeet

| Hanke | Kesto | Rahoittajat |

|---|---|---|

| DigiConsumers | - | Suomen Akatemian strategisen tutkimuksen neuvosto (STN), Suomen Akatemia |

| GLOBALINTO | - | EU - Horisontti |

| Pelilliset energia- ja kiertotalousratkaisut | - | EU - Euroopan aluekehitysrahasto EAKR 2014-2020 |